Provide a secure, frictionless customer experience

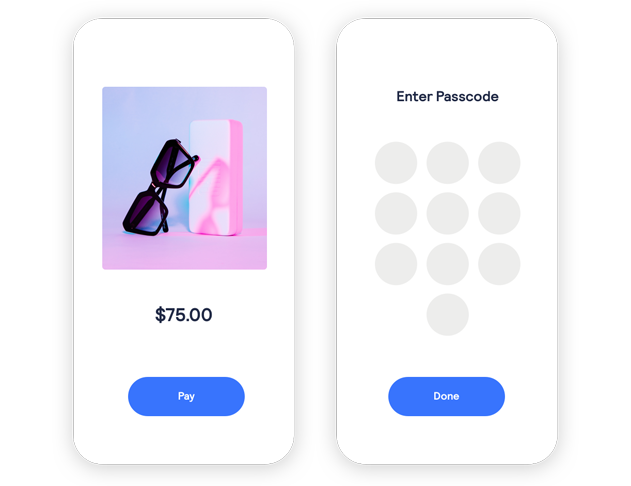

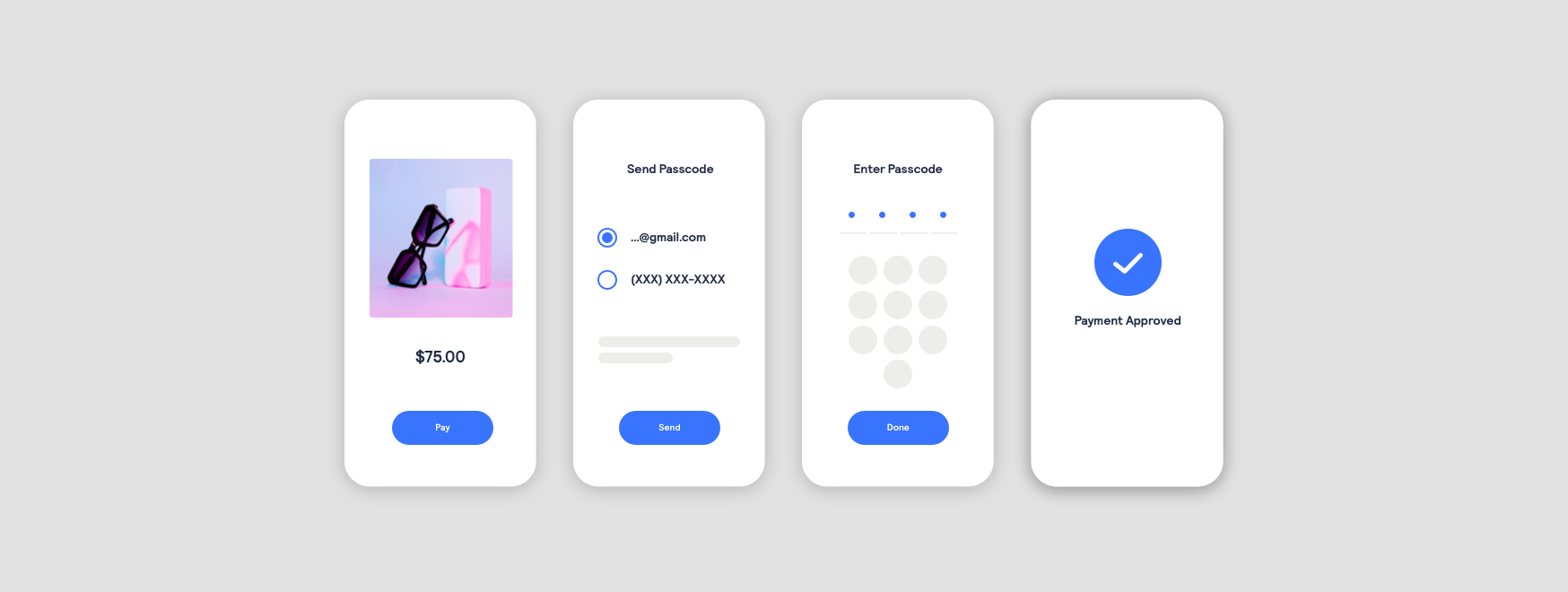

How 3-D Secure works

3-D Secure helps to minimize costly fraudulent transactions by adding an extra layer of protection to the payment process. The solution enables issuers to authenticate the cardholder using various available methods—from a one-time password to biometrics. Successful authentication helps confirm that the transaction comes from a real cardholder. This makes it more likely that the transaction will be authorized.

Our solution can silently authenticate most transactions by verifying customer data with the card issuer. For high-risk transactions, customers will be asked for additional authentication.

Protected, customer-friendly checkouts

With our exemption optimization solution, your customers can check out without performing a two-factor authentication, when allowed under PSD2 SCA requirements.

Offer easy verification on all devices

3-D Secure is compatible with the devices consumers use to shop with every day. It allows for various authentication methods, including biometrics, ensuring that the customer experience is seamless when authentication is required.

Shift fraud liability

In many cases, 3-D Secure can provide the additional benefit of shifting liability for fraudulent chargebacks from you to the card issuer.

Support for Visa Secure, Mastercard Identity Check (ID Check) and more

Many card issuers put in place protection programmes for online purchases. With our 3-D Secure solution, you can support protection programmes including Visa Secure, Mastercard Identity Check (ID Check), American Express SafeKey and JCB J/Secure—all with one connection to the Cybersource API.

Are you ready for PSD2 SCA?

PSD2 is the second European Payment Services Directive. It could revolutionize the payments industry, affecting everything from the way we pay online, to the information we see when making a payment.

Under the PSD2 Strong Customer Authentication (SCA) requirements, certain payment transactions now require two-factor authentication. If the issuer is unable to perform authentication, a transaction may be declined. 3-D Secure is a technology which allows merchants to support SCA.

This regulation affects everyone doing business in the European Economic Area (EEA).

Optimize SCA exemptions

SCA exemptions carve out situations where two-factor authentication does not need to be applied by issuers. In these scenarios, consumers can complete the transactions without additional steps. Our exemption optimization solution can help you identify when exemptions apply, and when to ask for them—so your customers can enjoy speedy, secure shopping experiences.

Related products

Fraud and risk management

Protect and help grow your revenue with our multilayered solution.

Delivery address verification

Correct mismatched address information for over 200 countries and territories.